Cermati Invest Weekly Update 28 Agustus 2023

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IDX Composite | 0.52% | 6,895.44 |

| IDX LQ45 | 0.00% | 956.72 |

| IDX 30 | 0.01% | 495.63 |

| MSCI Indonesia | 0.06% | 7,566.82 |

| FTSE Indonesia | 0.05% | 3,700.40 |

| USD/IDR | 0.12% | 15,298.10 |

Provided by AIT, last update 25 Agustus 2023

Market Review

Indeks Harga Saham Gabungan (IHSG) mengalami kenaikan selama sepekan perdagangan. Rupiah melemah terhadap dolar Amerika Serikat (AS) disebabkan sikap wait and see dari Bank Sentral Amerika dan hasil Rapat Dewan Gubernur (RDG) Bank Indonesia (BI).

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 1.40% | 1,914.60 |

| Crude Oil WTI | -1.48% | 80.05 |

| Palm Oil c3 F | 2.35% | 3,962 |

| Natural Gas | 0.04% | 2.55 |

| Newcastle Coal | -9.03% | 136.00 |

| Nickel | 3.18% | 20,772 |

| Tin | 2.41% | 25,870 |

| Copper | 1.54% | 8,367 |

| Aluminium | 0.84% | 2,155 |

| US Soybeans | 2.40% | 1,386.75 |

Provided by AIT, last update 25 Agustus 2023

Economic Data

Bursa Efek Indonesia (BEI) mencatatkan nilai rata-rata volume transaksi pada pekan ini mengalami kenaikan sebesar 6,66 persen menjadi 17,88 miliar lembar saham dari 16,77 miliar lembar saham pada pekan lalu. Pekan lalu, Bank Indonesia (BI) kembali memutuskan untuk mempertahankan suku bunga acuan. Rupiah dan inflasi menjadi alasan utama dalam penentuan kebijakan tersebut. BI 7-Day Reverse Repo Rate (BI7DRR) pada Agustus 2023 sebesar 5,75%. Suku bunga Deposit Facility sebesar 5,00%, dan suku bunga Lending Facility sebesar 6,50%.

Bank Indonesia (BI) menerbitkan instrumen baru untuk menopang stabilitas rupiah. Gubernur BI Perry Warjiyo mengumumkan akan menerbitkan instrumen operasi moneter kontraksi, yakni Sekuritas Rupiah Bank Indonesia (SRBI). Instrumen ini juga menjadi instrumen pro-market dalam rangka memperkuat upaya pendalaman pasar uang, mendukung upaya menarik aliran masuk modal asing dalam bentuk investasi portofolio, serta untuk optimalisasi aset SBN yang dimiliki Bank Indonesia.

Pekan ini, sentimen penggerak utama akan datang dari rilis data tingkat inflasi tahunan Indonesia pada hari Jumat (1/9/2023). Indeks harga konsumen (IHK) Agustus diperkirakan konsensus Trading Economics meningkat secara tahunan menjadi 3,37% dari bulan Juli di 3,08%.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | -0.45% | 34,346.90 |

| S&P 500 | 0.82% | 4,405.71 |

| FTSE 100 | 1.05% | 7,338.58 |

| DAX | 0.37% | 15,631.82 |

| Nikkei 225 | 0.56% | 31,627.50 |

| Hang Seng | 0.01% | 17,952.50 |

| Shanghai | -2.17% | 3,064.07 |

| KOSPI | 0.58% | 2,519.14 |

Provided by AIT, last update 25 Agustus 2023

Regional Info

Pada pasar Wall Street pergerakan pekan lalu didukung dari kinerja keuangan kuartalan produsen chip Nvidia, yang tengah dilanda euforia kecerdasan buatan (artificial intelligence/AI). Perusahaan juga meningkatkan panduan kinerja tahunannya. Direksi Nvidia memperkirakan pendapatan kuartal III-2023 akan naik menjadi US$16 miliar, atau meningkat 170% secara tahunan (year on year/yoy). Dari awal tahun saham (year to date/ytd) NVDIA sudah naik 221%.

Pada pasar Amerika, sentimen datang dari ketua Bank Sentral AS (The Fed) Jerome Powell menyampaikan pidatonya, mengatakan, bank sentral siap menaikkan suku bunga lebih lanjut untuk memerangi inflasi. Ketua Bank Sentral Amerika Serikat (Federal Reserve/The Fed) Jerome Powell menegaskan bahwa target inflasi adalah 2 persen. Di sisi lain, dia juga menunjukkan adanya kekhawatiran baru terhadap data ekonomi terkini dari AS. Perekonomian yang terus tumbuh di atas tren, kata Powell, dikhawatirkan akan ‘mengganggu’ Upaya The Fed untuk menekan laju inflasi untuk mencapai target 2 persen.

Harga minyak mentah dunia ditutup lebih tinggi pada pembukaan perdagangan Jumat (25/8/2023), melanjutkan penguatan pada perdagangan Kamis sebelumnya. Namun, dalam sepekan harga minyak mentah WTI terkoreksi 1,75% dan minyak mentah brent turun 0,38%. Penurunan dalam sepekan dipengaruhi oleh kekhawatiran para pelaku pasar mengenai pidato Powell pada Jumat kemarin. Data ekonomi yang lemah dan penguatan dolar masih membatasi kenaikan harga minyak.

Insight 2023 3rd Quarter, 9th week

IHSG, masih dalam area sideways, batas bawah 6806—6815 dan batas atas 6937-6970, tidak kemana-mana sejak pertengahan Juli 2023 lalu.

RUPIAH, sampai akhir pekan ini, masih berada di area 15220—15341, cenderung melemah terhadap mata uang Amerika (US Dollar). Kedepannya pelemahan menuju 15759.

EMAS, banyaknya data rilis pekan ini (lihat kalender), harga emas dunia pekan ini bergerak dalam area cukup lebar, batas bawah koreksinya di sekitar 1880 US per t’o, sedangkan batas atasnya menuju 1940 US per t’o., begitupun harga emas dalam rupiah.

CERMATI, Reksa Dana Campuran dan Reksa Dana Pasar Uang selama bursa saham masih sideways (mendatar), rupiah melemah, tetapi suku bunga & inflasi terkendali.

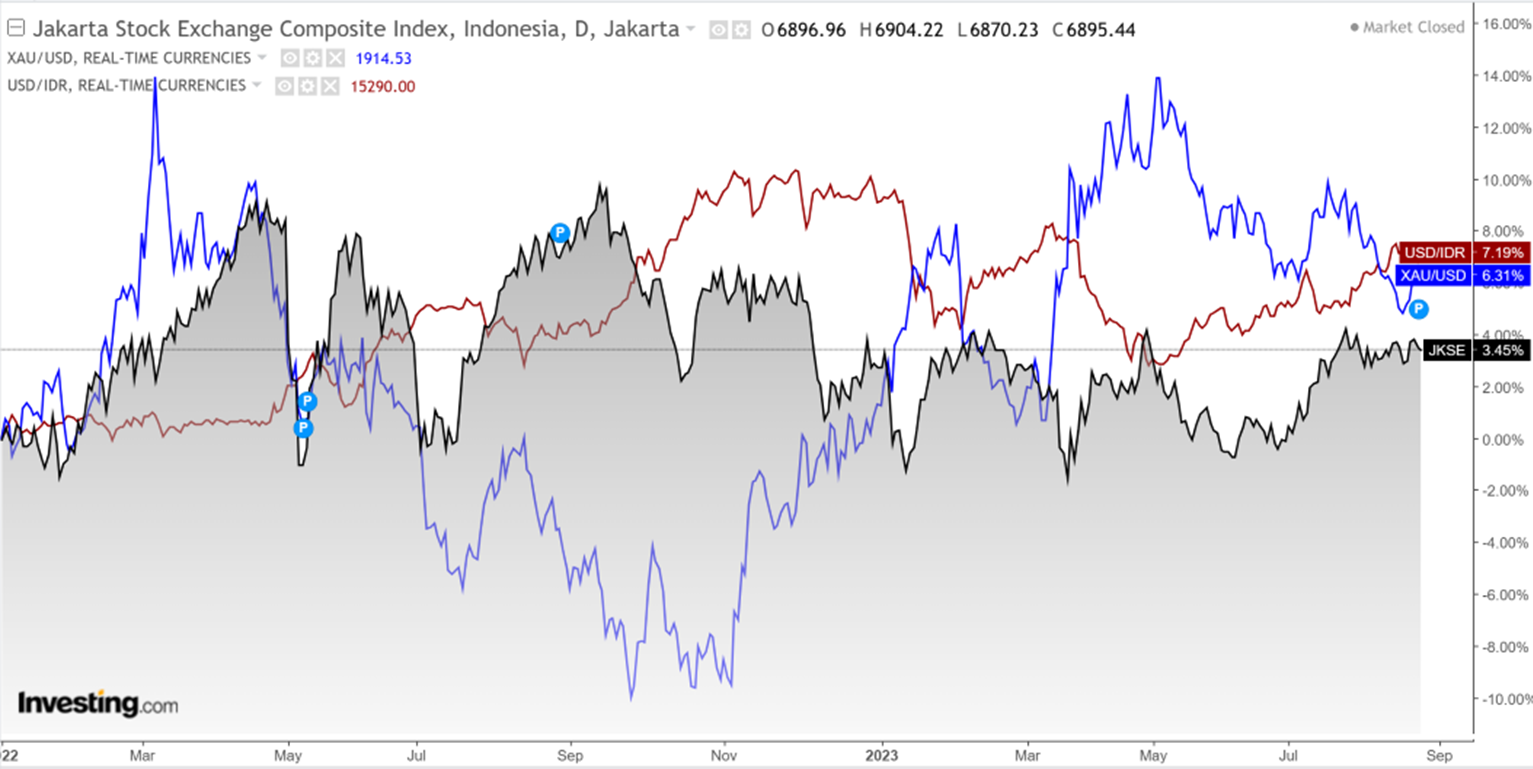

USDIDR & GOLD compare to COMPOSITE INDEX (Daily Performance) since 2022

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| TRIM Syariah Berimbang | 3166.99 | 2.59% | 6.19% | 8.38% | 1.13% | 23.02% | 28.57% | 216.70% | 27-Dec-06 | 20.27M |

| Syailendra Balanced Opportunity Fund | 3168.31 | 2.19% | 4.93% | 3.46% | -4.46% | 33.98% | 33.94% | 216.83% | 22-Apr-08 | 133.89M |

| Trimegah Balanced Absolute Strategy Kelas A | 1738.83 | 1.98% | 7.16% | 9.30% | 1.82% | 47.85% | - | 73.88% | 28-Dec-18 | 301.5M |

| TRIM Kombinasi 2 | 2686.35 | 1.84% | 7.05% | 8.52% | 3.06% | 27.73% | 13.03% | 168.63% | 10-Nov-06 | 24.26M |

| Setiabudi Dana Campuran | 1367.69 | 0.17% | 5.62% | 7.60% | 5.28% | 49.62% | 32.95% | 36.77% | 25-Sep-17 | 60.15M |

| Batavia Dana Dinamis | 9356.22 | -0.12% | 2.31% | 5.35% | 3.83% | 24.04% | 27.32% | 835.62% | 3-Jun-02 | 356.45M |

| SAM Mutiara Nusantara Nusa Campuran | 1821.52 | -1.89% | -0.38% | 6.30% | 1.14% | 35.83% | 79.18% | 82.15% | 21-Dec-17 | 29.21M |

Provided by AIT, last update 25 Agustus 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| Setiabudi Dana Pasar Uang | 1401.63 | 0.40% | 1.18% | 2.91% | 4.17% | 13.03% | 28.21% | 40.16% | 23-Dec-16 | 609.81M |

| Danakita Stabil Pasar Uang | 1510.85 | 0.40% | 1.16% | 2.89% | 4.14% | 13.04% | 26.68% | 51.08% | 10-Sep-15 | 147.76M |

| Trimegah Kas Syariah | 1332.53 | 0.36% | 1.08% | 2.72% | 4.07% | 11.53% | 23.36% | 33.25% | 30-Dec-16 | 353.14M |

| TRIM Kas 2 Kelas A | 1774.88 | 0.36% | 1.07% | 2.70% | 4.04% | 12.75% | 24.70% | 77.49% | 8-Apr-08 | 3.47T |

| Sequis Liquid Prima | 1348.27 | 0.36% | 1.08% | 2.59% | 3.35% | 9.42% | 21.79% | 34.83% | 8-Sep-16 | 39.47M |

| HPAM Ultima Money Market | 1507.25 | 0.35% | 1.05% | 2.94% | 4.28% | 14.49% | 29.19% | 50.73% | 10-Jun-15 | 619.95M |

| Syailendra Dana Kas | 1580.28 | 0.34% | 1.03% | 2.67% | 4.15% | 13.05% | 27.27% | 58.03% | 12-Jun-15 | 3.6T |

| Bahana Likuid Syariah Kelas G | 1127.28 | 0.34% | 1.02% | 2.59% | 3.71% | 10.46% | - | 12.73% | 12-Jul-16 | 151.85M |

| Batavia Dana Kas Maxima | 1691.39 | 0.33% | 0.97% | 2.38% | 3.25% | 9.41% | 21.58% | 69.14% | 20-Feb-07 | 10.55T |

| Insight Retail Cash Fund | 1473.54 | 0.32% | 1.18% | 2.95% | 4.00% | 13.39% | 29.51% | 47.35% | 13-Apr-18 | 2.8M |

| Bahana Dana Likuid | 1758.06 | 0.32% | 0.93% | 2.34% | 3.26% | 9.72% | 22.49% | 75.81% | 27-May-97 | 5.17T |

| BNI-AM Dana Likuid | 1796.27 | 0.29% | 0.90% | 2.46% | 3.35% | 10.34% | 23.71% | 79.63% | 27-Dec-12 | 728.48M |

| Danareksa Seruni Pasar Uang III | 1642.11 | 0.27% | 0.98% | 2.54% | 3.56% | 11.64% | 23.40% | 64.21% | 16-Feb-10 | 1.9T |

| SAM Dana Kas | 1351.34 | 0.25% | 0.94% | 2.61% | 3.52% | 10.41% | 24.23% | 35.13% | 10-Feb-17 | 202.09M |

| Cipta Dana Cash | 1590.09 | 0.24% | 0.97% | 2.81% | 4.36% | 13.00% | 27.05% | 59.01% | 8-Jun-15 | 175.63M |

| BNI-AM Dana Lancar Syariah | 1679.51 | 0.23% | 0.91% | 2.49% | 3.48% | 10.87% | 22.70% | 64.71% | 28-Jun-13 | 147.64M |

| Principal Cash Fund | 1753.2 | 0.10% | 0.74% | 2.41% | 3.06% | 10.25% | 23.11% | 75.32% | 23-Dec-11 | 137.01M |

| Eastspring Investment Cash Reserve Kelas A | 1593.87 | 0.08% | 0.67% | 1.98% | 2.55% | 6.46% | 18.04% | 59.39% | 3-Jul-13 | 49.6M |

Provided by AIT, last update 25 Agustus 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| Insight Haji Syariah | 4624.66 | 0.57% | 1.74% | 4.71% | 7.08% | 23.41% | 39.22% | 362.47% | 13-Jan-05 | 1.78T |

| TRIM Dana Tetap 2 | 2990.57 | 0.43% | 1.43% | 2.90% | 4.31% | 15.60% | 34.13% | 199.06% | 13-May-08 | 416.45M |

| Trimegah Fixed Income Plan | 1141.77 | 0.42% | 1.46% | 4.14% | 6.01% | 18.76% | - | 31.60% | 23-May-19 | 4.61T |

| Eastspring Syariah Fixed Income Amanah Kelas A | 1425.06 | -0.41% | 1.39% | 4.28% | 4.81% | 14.28% | 37.34% | 42.51% | 17-Apr-17 | 218.19M |

| Bahana Mes Syariah Fund Kelas G | 1484.79 | -0.44% | 1.44% | 4.40% | 5.67% | 15.13% | 37.81% | 48.48% | 11-Nov-16 | 240.78M |

| BNI-AM Dana Pendapatan Tetap Syariah Ardhani | 1571.78 | -0.48% | 1.61% | 5.78% | 6.48% | 18.42% | 48.46% | 57.18% | 16-Aug-16 | 398.05M |

| Batavia Dana Obligasi Ultima | 2902.24 | -0.61% | 0.42% | 3.23% | 4.50% | 10.92% | 28.30% | 212.98% | 20-Dec-06 | 1.39T |

| Cipta Bond | 1715.38 | -0.72% | -0.19% | 2.77% | 4.80% | 11.93% | 38.56% | 69.03% | 2-Jan-19 | 18.38M |

| SAM Sukuk Syariah Sejahtera | 2460.65 | -0.73% | 0.35% | 3.85% | 5.00% | 16.93% | 44.67% | 163.04% | 29-Oct-97 | 55.75M |

| Syailendra Fixed Income Fund | 2478.62 | -0.82% | 0.45% | 4.85% | 7.28% | 13.92% | 40.27% | 147.86% | 8-Dec-11 | 215.12M |

| HPAM Government Bond | 1521.2 | -0.85% | 0.58% | 4.97% | 7.27% | 14.33% | 39.31% | 52.12% | 18-May-16 | 20.68M |

| Principal Income Fund Syariah | 1094.91 | -0.86% | 2.09% | 4.80% | 7.46% | - | - | 9.49% | 21-Oct-20 | 3.47M |

| BNI-AM Dana Pendapatan Tetap Nirwasita | 1597.99 | -1.17% | 0.62% | 5.60% | 7.97% | 17.97% | 45.10% | 59.80% | 16-Jun-16 | 85.5M |

| Eastspring IDR Fixed Income Fund Kelas A | 1668.52 | -1.27% | 0.37% | 4.21% | 6.31% | 14.73% | 39.04% | 66.85% | 16-Mar-15 | 153.02M |

| Eastspring Investments IDR High Grade Kelas A | 1619.01 | -1.39% | 0.11% | 4.00% | 7.26% | 11.92% | 34.83% | 61.90% | 9-Jan-13 | 28.05M |

Provided by AIT, last update 25 Agustus 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| HPAM Ultima Ekuitas 1 | 2576.87 | 5.54% | 8.22% | 4.19% | -1.97% | 27.57% | 7.28% | 157.69% | 2-Nov-09 | 642.33M |

| TRIM Syariah Saham | 1942.68 | 2.63% | 6.10% | 6.90% | -1.74% | 19.53% | 18.04% | 94.27% | 27-Dec-06 | 96.61M |

| SAM Indonesian Equity Fund | 2201.99 | 2.28% | 9.99% | 9.71% | 5.84% | 39.37% | -6.02% | 134.41% | 18-Oct-11 | 1.05T |

| Eastspring Investments Alpha Navigator Kelas A | 1578.9 | 1.18% | 3.28% | 6.66% | 4.11% | 28.73% | 14.35% | 57.89% | 29-Aug-12 | 111.13M |

| Eastspring Investments Value Discovery Kelas A | 1361.24 | 1.12% | 2.97% | 3.86% | -0.88% | 26.76% | 7.99% | 36.12% | 29-May-13 | 466.25M |

| Batavia Dana Saham | 64481.73 | 1.06% | 3.84% | 5.54% | 3.16% | 20.93% | 6.80% | 2447.51% | 16-Dec-96 | 3.67T |

| TRIM Kapital Plus | 4387.35 | 0.78% | 5.33% | 12.84% | 7.31% | 49.08% | 21.86% | 338.73% | 18-Apr-08 | 170.47M |

| Batavia Disruptive Equity | 1056.26 | 0.78% | 4.64% | 8.58% | 4.68% | - | - | 5.63% | 15-Dec-21 | 23.65M |

| Syailendra Equity Opportunity Fund | 4143.9 | 0.78% | 5.17% | 8.13% | 2.26% | 24.32% | 5.20% | 314.39% | 7-Jun-07 | 374.94M |

| TRIM Kapital | 12232.07 | 0.50% | 4.12% | 11.74% | 6.43% | 44.63% | 13.91% | 1465.68% | 19-Mar-97 | 331.87M |

| Batavia Dana Saham Optimal | 3265.83 | 0.42% | 4.22% | 6.26% | 2.10% | 30.75% | 12.25% | 226.58% | 19-Oct-06 | 575.85M |

| BNI-AM Indeks IDX Growth30 Kelas R1 | 1165.21 | 0.32% | 3.45% | 5.53% | 4.46% | - | - | 16.52% | 27-Jan-22 | 929.68Jt |

| Principal Islamic Equity Growth Syariah | 1241.98 | 0.02% | 4.30% | 2.36% | 1.83% | 5.65% | -9.63% | 24.20% | 10-Sep-07 | 107.82M |

| Trimegah FTSE Indonesia Low Volatility Factor Index | 1289.42 | 0.01% | 1.14% | 9.12% | 10.30% | - | - | 28.94% | 3-Nov-20 | 21.23M |

| UOBAM Indeks Bisnis-27 | 1451.43 | 0.01% | 2.74% | 6.61% | 6.83% | 27.42% | 9.93% | 45.14% | 15-Aug-12 | 11.58M |

| Principal Indo Domestic Equity Fund | 828.59 | -0.10% | 3.39% | 4.13% | -3.04% | 6.05% | -9.98% | -17.14% | 11-Apr-13 | 22.84M |

| Syailendra MSCI Indonesia Value Index Fund Kelas A | 1186.81 | -0.11% | 2.06% | 13.17% | 9.78% | 28.14% | 16.16% | 18.68% | 8-Jun-18 | 771.65M |

| Bahana Primavera Plus | 13326.52 | -0.15% | 3.87% | -3.84% | -14.31% | 3.01% | -12.97% | 1133.01% | 27-May-97 | 76.14M |

| Danakita Saham Prioritas | 1180.19 | -0.31% | 2.21% | 7.30% | 7.97% | 25.69% | - | 18.02% | 17-Oct-18 | 11.32M |

| Sequis Equity Maxima | 987.95 | -0.37% | 3.03% | 3.55% | -0.14% | 14.66% | 0.02% | -1.21% | 25-Aug-16 | 1.44T |

| Principal Total Return Equity Fund Kelas O | 3445.42 | -0.54% | 3.12% | 2.81% | -3.49% | 9.61% | -3.99% | 244.54% | 1-Jul-05 | 38.96M |

| Bahana Primavera 99 Kelas G | 1315.84 | -0.60% | 2.97% | 3.84% | 1.02% | 14.59% | - | 31.58% | 5-Sep-14 | 25.67M |

| Cipta Rencana Cerdas | 18411.87 | -1.04% | 3.83% | 7.28% | 7.49% | 36.68% | 23.20% | 2590.50% | 9-Jul-99 | 114.54M |

| Cipta Saham Unggulan Syariah | 2643.2 | -1.26% | 9.06% | 13.24% | 7.68% | 68.38% | - | 164.32% | 5-Sep-18 | 26.14M |

| Cipta Saham Unggulan | 3101.29 | -1.92% | 7.57% | 12.06% | 11.00% | 72.84% | - | 210.13% | 4-Dec-18 | 68.23M |

Provided by AIT, last update 25 Agustus 2023

Event Calendar

| Monday, 28 August 2023 | Previous | Consensus | Forecast | ||

| 9:30 PM | US | Dallas Fed Manufacturing Index AUG | -20 | -21.6 | -21 |

| Tuesday, 29 August 2023 | Previous | Consensus | Forecast | ||

| 6:30 AM | JP | Unemployment Rate JUL | 2.5% | 2.5% | 2.5% |

| 1:00 PM | DE | GfK Consumer Confidence SEP | -24.4 | -24.3 | -23 |

| 8:00 PM | US | S&P/Case-Shiller Home Price MoM JUN | 1.5% | 1.3% | |

| 8:00 PM | US | S&P/Case-Shiller Home Price YoY JUN | -1.7% | -1.4% | -1.1% |

| 9:00 PM | US | JOLTs Job Openings JUL | 9.582M | 9.57M | |

| 9:00 PM | US | CB Consumer Confidence AUG | 117 | 116 | 116 |

| Wednesday, 30 August 2023 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change AUG/25 | -2.418M | ||

| 12:00 PM | JP | Consumer Confidence AUG | 37.1 | 37.2 | |

| 3:30 PM | GB | BoE Consumer Credit JUL | £1.661B | £1.5B | £1.2B |

| 3:30 PM | GB | Mortgage Lending JUL | £0.136B | £0.5B | |

| 3:30 PM | GB | Mortgage Approvals JUL | 54.662K | 51K | 55.7K |

| 6:00 PM | US | MBA 30-Year Mortgage Rate AUG/25 | 7.31% | ||

| 7:00 PM | DE | Inflation Rate YoY Prel AUG | 6.2% | 6.0% | 6.1% |

| 7:00 PM | DE | Inflation Rate MoM Prel AUG | 0.3% | 0.3% | 0.3% |

| 7:15 PM | US | ADP Employment Change AUG | 324K | 195K | 210K |

| 7:30 PM | US | Goods Trade Balance Adv JUL | $-87.84B | $ -94.0B | |

| 7:30 PM | US | GDP Price Index QoQ 2nd Est Q2 | 4.1% | 2.2% | 2.2% |

| 7:30 PM | US | Corporate Profits QoQ Prel Q2 | -5.9% | -5.0% | |

| 7:30 PM | US | GDP Growth Rate QoQ 2nd Est Q2 | 2.0% | 2.4% | 2.4% |

| 9:00 PM | US | Pending Home Sales MoM JUL | 0.3% | -0.4% | |

| 9:00 PM | US | Pending Home Sales YoY JUL | -15.6% | -12.0% | |

| 9:30 PM | US | EIA Gasoline Stocks Change AUG/25 | 1.467M | ||

| 9:30 PM | US | EIA Crude Oil Stocks Change AUG/25 | -6.135M | ||

| Thursday, 31 August 2023 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Industrial Production MoM Prel JUL | 2.4% | -1.4% | -1.2% |

| 6:50 AM | JP | Retail Sales YoY JUL | 5.9% | 5.4% | 5.1% |

| 8:30 AM | CN | NBS Manufacturing PMI AUG | 49.3 | 49.5 | 49.5 |

| 8:30 AM | CN | NBS Non Manufacturing PMI AUG | 51.5 | 51 | |

| 8:30 AM | JP | BoJ Nakamura Speech | |||

| 12:00 PM | JP | Housing Starts YoY JUL | -4.8% | -0.8% | -1.4% |

| 1:00 PM | DE | Retail Sales MoM JUL | -0.8% | 0.3% | 0.3% |

| 1:00 PM | DE | Retail Sales YoY JUL | -1.6% | -1.5% | -0.9% |

| 2:15 PM | GB | BoE Pill Speech | |||

| 2:55 PM | DE | Unemployed Persons AUG | 2.604M | 2.619M | |

| 2:55 PM | DE | Unemployment Change AUG | -4K | 10K | 15.0K |

| 2:55 PM | DE | Unemployment Rate AUG | 5.6% | 5.6% | 5.7% |

| 7:30 PM | US | Core PCE Price Index MoM JUL | 0.2% | 0.2% | 0.2% |

| 7:30 PM | US | Personal Income MoM JUL | 0.3% | 0.3% | 0.3% |

| 7:30 PM | US | Personal Spending MoM JUL | 0.5% | 0.6% | 0.4% |

| 7:30 PM | US | Initial Jobless Claims AUG/26 | 230K | 235K | 236.0K |

| 7:30 PM | US | PCE Price Index YoY JUL | 3.0% | 3.3% | 3.2% |

| 7:30 PM | US | PCE Price Index MoM JUL | 0.2% | 0.2% | 0.2% |

| 8:00 PM | US | Fed Collins Speech | |||

| 8:45 PM | US | Chicago PMI AUG | 42.8 | 44 | 45 |

| GB | Nationwide Housing Prices YoY AUG | -3.8% | -4.9% | ||

| GB | Nationwide Housing Prices MoM AUG | -0.2% | -0.2% | ||

| Friday, 01 September 2023 | Previous | Consensus | Forecast | ||

| 7:30 AM | JP | Jibun Bank Manufacturing PMI Final AUG | 49.6 | 49.7 | |

| 8:45 AM | CN | Caixin Manufacturing PMI AUG | 49.2 | 49.4 | 49.3 |

| 11:00 AM | ID | Inflation Rate YoY AUG | 3.1% | 3.4% | 3.0% |

| 2:55 PM | DE | HCOB Manufacturing PMI Final AUG | 38.8 | 39.1 | 39.1 |

| 3:30 PM | GB | S&P Global/CIPS Manufacturing PMI Final AUG | 45.3 | 42.5 | 42.5 |

| 7:30 PM | US | Non Farm Payrolls AUG | 187K | 170K | 180.0K |

| 7:30 PM | US | Unemployment Rate AUG | 3.5% | 3.5% | 3.5% |

| 7:30 PM | US | Average Hourly Earnings YoY AUG | 4.4% | 4.4% | 4.4% |

| 7:30 PM | US | Average Hourly Earnings MoM AUG | 0.4% | 0.3% | 0.4% |

| 7:30 PM | US | Participation Rate AUG | 62.6% | 62.6% | |

| 8:45 PM | US | S&P Global Manufacturing PMI Final AUG | 49 | 47 | 47 |

| 9:00 PM | US | ISM Manufacturing PMI AUG | 46.4 | 47 | 47 |

| 9:00 PM | US | ISM Manufacturing Employment AUG | 44.4 | 46 | |

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 21 Agustus 2023

- Cermati Invest Weekly Update 14 Agustus 2023

- Cermati Invest Weekly Update 7 Agustus 2023

- Cermati Invest Weekly Update 31 Juli 2023