Cermati Invest Weekly Update 7 Agustus 2023

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IDX Composite | -0.69% | 6,852.84 |

| IDX LQ45 | -0.28% | 958.97 |

| IDX 30 | -0.26% | 498.29 |

| MSCI Indonesia | -0.05% | 7,590.23 |

| FTSE Indonesia | 0.00% | 3,703.52 |

| USD/IDR | 0.42% | 15,153 |

Provided by AIT, last update 4 Agustus 2023

Market Review

Indeks Harga Saham Gabungan (IHSG) terkoreksi selama pekan lalu di tengah berbagai sentimen dan penantian pengumuman pertumbuhan ekonomi Indonesia kuartal-II 2023.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | -0.83% | 1,942.90 |

| Crude Oil WTI | 2.56% | 82.64 |

| Palm Oil c3 F | -3.67% | 3,859 |

| Natural Gas | -2.24% | 2.58 |

| Newcastle Coal | 1.15% | 136.00 |

| Nickel | -4.39% | 21,329 |

| Tin | -3.62% | 27,700 |

| Copper | -1.25% | 8,554 |

| Aluminium | 0.86% | 2,241 |

| US Soybeans | -3.73% | 1,331.00 |

Provided by AIT, last update 4 Agustus 2023

Economic Data

Pada perdagangan pekan lalu, koreksi IHSG sejalan tekanan aksi jual investor asing yang mencatatkan aksi jual bersih (net sell) mencapai Rp469,05 miliar di seluruh pasar pada perdagangan penutupan pekan lalu. Nilai mata uang rupiah melemah sepekan kemarin akibat dari pemberlakuan aturan baru dari Devisa Hasil Ekspor (DHE). Aturan ini akan mewajibkan DHE Sumber Daya Alam (SDA) untuk disimpan di sistem keuangan dalam negeri minimal 3 bulan. Adapun, nilai devisa ekspor yang wajib ditahan ini di atas US$ 250.000 dengan minimal jumlah yang ditempatkan di sistem keuangan domestik 30% dari total nilai ekspor.

Pasar pekan ini dihadapkan dengan sejumlah data dan agenda penting, utamanya dari pasar domestik dengan rilis data Produk Domestik Bruto (PDB) Indonesia kuartal-II 2023. Pertumbuhan ekonomi Indonesia pada kuartal II-2023 diperkirakan menurun meskipun konsumsi masyarakat sudah jauh membaik.

Selain itu, Indonesia akan merilis data cadangan devisa (cadev) pekan ini. Sebelumnya, cadev Indonesia tercatat sebesar US$ 137,5 miliar pada Juni. Nilai tersebut menurun dari bulan sebelumnya yang sebesar US$ 139,3 miliar. Cadev menunjukkan tren penurunan, telah tertekan tiga kali berturut-turut dari titik tertingginya pada bulan Maret 2023. Pelemahan cadev akan berpotensi menjadi sentimen pelemahan rupiah. Dengan cadev yang menurun maka itu mencerminkan pasokan dolar AS yang menipis.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | -1.11% | 35,065.62 |

| S&P 500 | -2.27% | 4,478.03 |

| FTSE 100 | -1.69% | 7,564.37 |

| DAX | -3.14% | 15,951.86 |

| Nikkei 225 | -1.79% | 32,172.50 |

| Hang Seng | -1.90% | 19,538.00 |

| Shanghai | 0.37% | 3,288.08 |

| KOSPI | -0.21% | 2,602.80 |

Provided by AIT, last update 4 Agustus 2023

Regional Info

Pekan lalu, pasar AS disibukkan dengan rilis data kinerja perusahaan kuartal-II 2023. Laba perusahaan ecommerce terbesar, Amazon, melonjak 8,3% ke level tertinggi dalam hampir setahun terakhir, lebih tinggi dari ekspektasi dan menawarkan kesempatan positif. Di sisi lain, Apple malah kehilangan 4,8% pendapatannya secara tahunan (yoy). Sentimen lainnya yaitu lembaga Fitch Rating menurunkan peringkat surat utang AS dari AAA menjadi AA+ yang merupakan konsekuensi dari dampak persoalan plafon utang pada Mei lalu. Penurunan oleh Fitch ini belum pernah terjadi sebelumnya. Peringkat AAA adalah tertinggi sementara AA+ adalah lebih rendah di bawah AAA. Penurunan peringkat utang AS dapat membuat ketidakpastian global kembali meninggi.

Laporan data pekerja yang membaik menjadi petunjuk tentang keadaan pasar tenaga kerja dengan rilis laporan gaji hari Jumat lalu.Data menunjukkan 187.000 pekerjaan ditambahkan pada bulan Juli, di bawah harapan ekonom yang disurvei Dow Jones menjadi 200.000. Tingkat pengangguran juga berdetak lebih rendah menjadi 3,5% dari 3,6%. Data pekerja terbaru dinanti pelaku pasar terkait implikasinya terhadap siklus kenaikan suku bunga Bank Sentral AS (Federal Reserve/The Fed).

Data penting yang juga akan dirilis pekan ini adalah neraca perdagangan China pada hari Selasa (8/8). Peningkatan nilai ekspor dan impor China akan berdampak positif terhadap perekonomian domestik. Peningkatan impor China menjadi kabar gembira untuk sektor komoditas dalam negeri seperti batu bara, sebab Indonesia merupakan salah satu negara dengan tujuan ekspor batu bara terbesar ke China.

Insight 2023 3rd Quarter, 6th week

IHSG, pekan lalu ditutup 6852.84, terkoreksi (–) 0.69% selama sepekan. Pekan ini koreksi ke 6789.01, sedangkan batas atasnya masih di sekitar 6971.3

RUPIAH, sepekan lalu melemah (-) 0.42% ke posisi 15153, pelemahan ini masih akan berlangsung ke arah 15345, bahkan tidak menutup kemungkinan ke depannya 15759. Pekan ini, bila menguat hanya sekitar ke sekitar 14967.

EMAS, pekan lalu melemah (-) 0.83% ke posisi 1942. Pekan ini bergerak di area 1924 – 1954, diawali dengan penguatan. Ke depannya tidak menutup kemungkinan bergerak naik ke 1982 per t’o dengan batas bawah 1902 per t’o. Dalam rupiah emas berkisar antara 938462 – 977935.

REKSA DANA, walaupun pekan ini IHSG kemungkinan masih terkoreksi, Reksa Dana Campuran dan Reksa Dana Saham 1 bulan ini masih unggul performanya dibandingkan dengan reksa dana jenis lainnya.

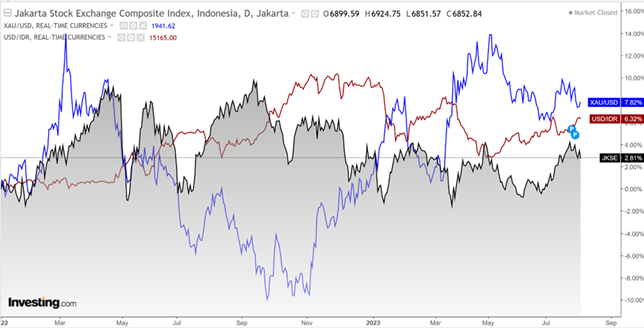

USDIDR & GOLD compare to COMPOSITE INDEX (Daily Performance) since 2022

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| Batavia Dana Dinamis | 9355.17 | 0.33% | 3.17% | 5.34% | 5.10% | 28.85% | 26.36% | 835.52% | 3-Jun-02 | 367.44M |

| Principal Balanced Strategic Plus | 1280.1 | 0.76% | 3.11% | 6.28% | 6.16% | 25.46% | 4.38% | 28.01% | 28-May-12 | 7.99M |

| SAM Mutiara Nusantara Nusa Campuran | 1848.17 | -0.47% | 1.16% | 7.85% | 2.18% | 51.91% | 79.08% | 84.82% | 21-Dec-17 | 28.99M |

| Setiabudi Dana Campuran | 1367.91 | 2.69% | 5.06% | 7.62% | 7.16% | 58.80% | 32.55% | 36.79% | 25-Sep-17 | 59.18M |

| Syailendra Balanced Opportunity Fund | 3149.26 | 0.89% | 4.87% | 2.84% | -6.26% | 40.84% | 30.88% | 214.93% | 22-Apr-08 | 152.25M |

| TRIM Kombinasi 2 | 2662.05 | 2.56% | 8.85% | 7.54% | 3.35% | 32.33% | 11.80% | 166.20% | 10-Nov-06 | 23.54M |

| TRIM Syariah Berimbang | 3140.85 | 2.56% | 6.48% | 7.48% | 1.49% | 26.62% | 25.88% | 214.08% | 27-Dec-06 | 19.84M |

| Trimegah Balanced Absolute Strategy Kelas A | 1724.51 | 2.88% | 9.05% | 8.40% | 2.30% | 51.09% | - | 72.45% | 28-Dec-18 | 288.64M |

Provided by AIT, last update 4 Agustus 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| Cipta Dana Cash | 1587.33 | 0.42% | 1.10% | 2.63% | 4.30% | 13.15% | 27.24% | 58.73% | 8-Jun-15 | 190.18M |

| Danakita Stabil Pasar Uang | 1506.68 | 0.39% | 1.14% | 2.61% | 4.00% | 13.09% | 26.74% | 50.67% | 10-Sep-15 | 164.78M |

| HPAM Ultima Money Market | 1503.62 | 0.33% | 1.07% | 2.69% | 4.24% | 14.68% | 29.28% | 50.36% | 10-Jun-15 | 753.19M |

| Insight Retail Cash Fund | 1470.67 | 0.37% | 1.34% | 2.75% | 4.01% | 13.50% | 29.95% | 47.07% | 13-Apr-18 | 2.95M |

| Setiabudi Dana Pasar Uang | 1397.76 | 0.39% | 1.17% | 2.62% | 4.07% | 13.08% | 28.29% | 39.78% | 23-Dec-16 | 619.05M |

| Syailendra Dana Kas | 1576.77 | 0.35% | 1.05% | 2.44% | 4.07% | 13.17% | 27.40% | 57.68% | 12-Jun-15 | 4.01T |

| TRIM Kas 2 Kelas A | 1770.56 | 0.36% | 1.07% | 2.45% | 3.98% | 12.81% | 24.80% | 77.06% | 8-Apr-08 | 3.32T |

| Trimegah Kas Syariah | 1329.3 | 0.36% | 1.08% | 2.47% | 4.01% | 11.50% | 23.37% | 32.93% | 30-Dec-16 | 434.95M |

Provided by AIT, last update 4 Agustus 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| Bahana Mes Syariah Fund Kelas G | 1490.61 | 0.02% | 2.87% | 4.81% | 7.04% | 17.04% | 37.61% | 49.06% | 11-Nov-16 | 607.12M |

| BNI-AM Dana Pendapatan Tetap Nirwasita | 1612.47 | -0.07% | 2.23% | 6.55% | 10.14% | 20.87% | 46.83% | 61.25% | 16-Jun-16 | 68.11M |

| BNI-AM Dana Pendapatan Tetap Syariah Ardhani | 1578.73 | 0.02% | 3.13% | 6.25% | 7.53% | 21.06% | 48.36% | 57.87% | 16-Aug-16 | 316.02M |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1055.8 | -0.19% | 1.35% | 4.64% | - | - | - | 7.41% | 1-Sep-22 | 5.46M |

| Danakita Obligasi Negara | 1068.59 | -0.24% | 1.57% | 3.71% | 6.35% | - | - | 6.86% | 26-Mar-21 | 54.4M |

| Eastspring IDR Fixed Income Fund Kelas A | 1683.9 | -0.33% | 1.91% | 5.17% | 8.40% | 17.52% | 40.52% | 68.39% | 16-Mar-15 | 131.92M |

| Eastspring Investments IDR High Grade Kelas A | 1633.41 | -0.54% | 1.26% | 4.93% | 8.78% | 14.46% | 35.93% | 63.34% | 9-Jan-13 | 25.72M |

| Eastspring Syariah Fixed Income Amanah Kelas A | 1431.17 | 0.07% | 2.81% | 4.72% | 5.94% | 16.92% | 37.75% | 43.12% | 17-Apr-17 | 209.79M |

| HPAM Government Bond | 1530.24 | -0.28% | 1.78% | 5.59% | 8.72% | 16.73% | 39.98% | 53.02% | 18-May-16 | 21.06M |

| Insight Haji Syariah | 4606.87 | 0.58% | 1.76% | 4.30% | 7.26% | 23.99% | 39.06% | 360.69% | 13-Jan-05 | 1.61T |

| Principal Income Fund Syariah | 1104.86 | -0.28% | 4.00% | 5.75% | 7.57% | - | - | 10.49% | 21-Oct-20 | 3.39M |

| SAM Sukuk Syariah Sejahtera | 2473.01 | -0.24% | 1.50% | 4.36% | 5.81% | 18.76% | 44.60% | 164.28% | 29-Oct-97 | 54.14M |

| Syailendra Fixed Income Fund | 2491.79 | -0.14% | 1.45% | 5.41% | 8.93% | 15.74% | 40.49% | 149.18% | 8-Dec-11 | 243.11M |

| Trimegah Fixed Income Plan | 1138.57 | 0.49% | 1.54% | 3.85% | 6.21% | 19.62% | - | 31.28% | 23-May-19 | 3.84T |

Provided by AIT, last update 4 Agustus 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| Batavia Dana Saham Optimal | 3238.13 | -0.35% | 3.24% | 5.36% | 2.35% | 36.23% | 8.98% | 223.81% | 19-Oct-06 | 661.93M |

| Batavia Disruptive Equity | 1048.45 | 0.39% | 4.38% | 7.78% | 3.59% | - | - | 4.84% | 15-Dec-21 | 46.2M |

| Cipta Rencana Cerdas | 18505.83 | 0.92% | 5.51% | 7.83% | 8.86% | 46.44% | 23.01% | 2604.23% | 9-Jul-99 | 107.3M |

| Cipta Saham Unggulan | 3129.38 | 2.06% | 11.05% | 13.07% | 12.39% | 79.68% | - | 212.94% | 4-Dec-18 | 51.63M |

| Cipta Saham Unggulan Syariah | 2648.57 | 1.63% | 13.46% | 13.47% | 8.06% | 81.64% | - | 164.86% | 5-Sep-18 | 20.57M |

| Danakita Saham Prioritas | 1177.71 | 0.77% | 2.00% | 7.08% | 9.05% | 33.58% | - | 17.77% | 17-Oct-18 | 11.27M |

| Eastspring Investments Alpha Navigator Kelas A | 1573.53 | 1.78% | 4.07% | 6.30% | 5.19% | 35.94% | 13.14% | 57.35% | 29-Aug-12 | 127.36M |

| SAM Indonesian Equity Fund | 2181.07 | 4.18% | 9.36% | 8.69% | 6.76% | 48.25% | -10.59% | 132.32% | 18-Oct-11 | 995.38M |

| Syailendra Equity Opportunity Fund | 4112.61 | 1.08% | 5.47% | 7.32% | 1.88% | 31.55% | 2.73% | 311.26% | 7-Jun-07 | 360.97M |

| Syailendra MSCI Indonesia Value Index Fund Kelas A | 1184.61 | 1.16% | 4.37% | 12.96% | 11.03% | 43.76% | 15.72% | 18.46% | 8-Jun-18 | 743.79M |

| TRIM Kapital | 12238.44 | 1.27% | 6.05% | 11.79% | 7.43% | 51.55% | 13.58% | 1466.50% | 19-Mar-97 | 255.84M |

| TRIM Kapital Plus | 4385.05 | 1.97% | 7.41% | 12.78% | 7.89% | 58.81% | 21.52% | 338.50% | 18-Apr-08 | 168.59M |

| Trimegah FTSE Indonesia Low Volatility Factor Index | 1283.95 | 0.53% | 1.97% | 8.65% | 11.47% | - | - | 28.40% | 3-Nov-20 | 33.13M |

Provided by AIT, last update 4 Agustus 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | YtD | 1Y | 3Y | 5Y | % | Date | AUM |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 0.97 | -0.59% | 3.47% | 0.13% | -6.91% | -21.13% | -14.03% | -3.34% | 28-Oct-16 | 6.27Jt |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.67 | 1.22% | 4.49% | -4.99% | -11.35% | -40.56% | - | -33.47% | 15-Jun-20 | 9.72Jt |

| Eastspring Syariah Fixed Income USD Kelas A | 0.92 | 0.02% | -0.95% | 0.29% | -0.86% | - | - | -7.85% | 8-Mar-21 | 1.03Jt |

Provided by AIT, last update 4 Agustus 2023

Event Calendar

| Monday, 07 August 2023 | Previous | Consensus | Forecast | ||

| 11:00 AM | ID | GDP Growth Rate QoQ Q2 | -0.92% | 3.72% | 3.30% |

| 11:00 AM | ID | GDP Growth Rate YoY Q2 | 5.03% | 4.93% | 4.90% |

| 1:00 PM | DE | Industrial Production MoM JUN | -0.20% | -0.50% | -0.20% |

| 1:00 PM | GB | Halifax House Price Index MoM JUL | -0.10% | -0.60% | |

| 1:00 PM | GB | Halifax House Price Index YoY JUL | -2.60% | -3.10% | |

| Tuesday, 08 August 2023 | Previous | Consensus | Forecast | ||

| 6:01 AM | GB | BRC Retail Sales Monitor YoY JUL | 4.20% | 3.80% | |

| 6:50 AM | JP | Current Account JUN | ¥1862.4B | ¥1395B | ¥ 1920.0B |

| 10:00 AM | CN | Balance of Trade JUL | $70.62B | $69B | |

| 10:00 AM | CN | Exports YoY JUL | -12.40% | -14.00% | |

| 10:00 AM | CN | Imports YoY JUL | -6.80% | -5.20% | |

| 1:00 PM | DE | Inflation Rate YoY Final JUL | 6.40% | 6.20% | 6.20% |

| 1:00 PM | DE | Inflation Rate MoM Final JUL | 0.30% | 0.30% | 0.30% |

| 7:30 PM | US | Exports JUN | $247.1B | $247.8B | |

| 7:30 PM | US | Imports JUN | $316.1B | $312.9B | |

| 7:30 PM | US | Balance of Trade JUN | $-69B | $-65B | $-65.1B |

| 9:00 PM | US | IBD/TIPP Economic Optimism AUG | 41.3 | 42 | |

| Wednesday, 09 August 2023 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change AUG/04 | -15.4M | ||

| 8:30 AM | CN | Inflation Rate YoY JUL | 0.00% | -0.30% | |

| 8:30 AM | CN | Inflation Rate MoM JUL | -0.20% | 0.20% | |

| 8:30 AM | CN | PPI YoY JUL | -5.40% | -5.00% | |

| 4:30 PM | DE | 10-Year Bund Auction | 2.64% | ||

| 6:00 PM | US | MBA 30-Year Mortgage Rate AUG/04 | 6.93% | ||

| 9:30 PM | US | EIA Crude Oil Stocks Change AUG/04 | -17.049M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change AUG/04 | 1.48M | ||

| 11:00 PM | RU | Inflation Rate MoM JUL | 0.40% | 0.70% | 0.80% |

| 11:00 PM | RU | Inflation Rate YoY JUL | 3.20% | 4.30% | 4.10% |

| Thursday, 10 August 2023 | Previous | Consensus | Forecast | ||

| 7:30 PM | US | Core Inflation Rate MoM JUL | 0.20% | 0.20% | 0.20% |

| 7:30 PM | US | Inflation Rate MoM JUL | 0.20% | 0.20% | 0.20% |

| 7:30 PM | US | Core Inflation Rate YoY JUL | 4.80% | 4.70% | 4.80% |

| 7:30 PM | US | Inflation Rate YoY JUL | 3.00% | 3.30% | 3.10% |

| 7:30 PM | US | CPI JUL | 305.109 | 305.805 | 305.5 |

| 7:30 PM | US | CPI s.a JUL | 303.841 | 304.4 | |

| 7:30 PM | US | Initial Jobless Claims AUG/05 | 227K | 230K | 229.0K |

| Friday, 11 August 2023 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | Monthly Budget Statement JUL | $-228B | ||

| 1:00 PM | GB | GDP MoM JUN | -0.10% | 0.20% | 0.10% |

| 1:00 PM | GB | GDP Growth Rate YoY Prel Q2 | 0.20% | 0.20% | 0.10% |

| 1:00 PM | GB | GDP Growth Rate QoQ Prel Q2 | 0.10% | 0.00% | 0.10% |

| 1:00 PM | GB | Goods Trade Balance JUN | £-18.723B | £ -17.2B | |

| 1:00 PM | GB | Goods Trade Balance Non-EU JUN | £-6.757B | £-6.0B | |

| 1:00 PM | GB | Industrial Production MoM JUN | -0.60% | 0.00% | 0.10% |

| 1:00 PM | GB | GDP 3-Month Avg JUN | 0% | 0.10% | 0.10% |

| 1:00 PM | GB | Manufacturing Production MoM JUN | -0.20% | 0.20% | 0.20% |

| 1:00 PM | GB | Business Investment QoQ Prel Q2 | 3.30% | 0.60% | |

| 7:30 PM | US | PPI MoM JUL | 0.10% | 0.20% | 0.20% |

| 7:30 PM | US | Core PPI MoM JUL | 0.10% | 0.20% | 0.20% |

| 8:00 PM | RU | Balance of Trade JUN | RUB10.420B | RUB 6.400B | RUB 7.8B |

| 9:00 PM | US | Michigan Consumer Sentiment Prel AUG | 71.6 | 71 | 71.3 |

| 11:00 PM | RU | GDP Growth Rate YoY Prel Q2 | -1.80% | 4.70% | 4.20% |

| CN | New Yuan Loans JUL | CNY3050B |

CNY1810.0B

|

||

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 31 Juli 2023

- Cermati Invest Weekly Update 24 Juli 2023

- Cermati Invest Weekly Update 17 Juli 2023

- Cermati Invest Weekly Update 10 Juli 2023